Single Family Rental companies are raising the fees they charge renters while cutting back the services they provide. At the same time, investors are worried that an earning recession could hit their returns in the next six month. And Sears is still bankrupt. No matter where you look in the news recently, you find that numerous companies are focusing on providing shareholders with a short term return. Is that indeed the best strategy? Why are CEOs so focused on the short term results and should the board step in to correct the issues?

The Case for Longterm Sucess

If you look at the number of failed companies in the last year, Toys’R’Us and Sears among others, the one thing these companies have in common is that they all lacked a long term vision. Without an idea of the future and a focus on long term success, there cannot be a company that produces excellent results.

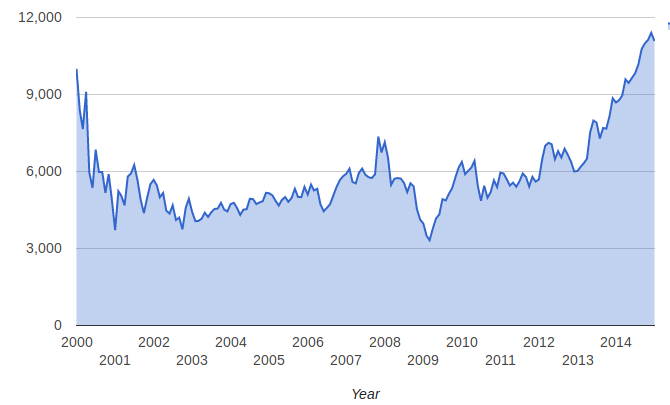

However, another problem is, that there are companies, that produce exceptional results one year, to plunge into stagnation for decades to come. Microsoft between 2001 and 2012 would be one of the examples that come to the mind. The phenomenal growth in the dot com bubble with a focus on ever higher growth, yet Steve Balmer never could install a coherent long term vision.

Results and Bonuses

When looking at all these issues, it is quite clear that the request for short term earnings come from the top. No call center agent at a rental company and no floor employee at Sears can ever decide to cut back customer service to raise the bottom line. Sales staff often earns a commission on sales, and it is in their best interest that the customers are happy and returning.

Executives in contrast often receive their bonus based on the bottom line for one particular year. Revenue, cost of goods and expenses all flow into the balance sheet. Consequently, management has a lot more options to tweak the performance of the bottom line then good customer service and repeated customers.

However, repeated customers and steady renters create value over multiple years, especially if the transaction is annual. Cutting a staff member impacts the results for the current year. Thus for the bonus of the executive, the fact that the company is worth off might be an advantage. Additionally, the average S&P 500 CEO holds their position for seven years according to a Harvard study. Consequently, any long term outlook might not impact the timeframe of their tenure.

Short term news

But the request for ever better short term balance sheets does not come from the executives themselves. Shareholders, especially institutional shareholders, and hedge funds demand an ever-accelerating rate of return. Even mom and pop investors focus much more on this year’s performance than on any future outlook.

Our ever-accelerating news cycle only supports this development. Headlines such as “Amazon up by 10%” or “Facebook IPO up 100%” sell considerably better than a focus on the long term development of a midwest craft beer producer or the multi-year return of a rural fiber network in Virginia.

Unless we get our shareholders to look beyond these headlines, we will never get to the point of breaking this cycle. We will only be able to generate long term technological advancement and profit growth if we can convince all stakeholders, that a long term outlook should take advantage over short term profits.

Boring Communication

One part of the problem is how we communicate with our employees and shareholders. Most corporate communications departments in good years only show the bottom line and do not focus on the long term values. In bad years, however, we love to talk about the long term outlook, paint sketchy visions and how cost-cutting helps to save us.

In my opinion, this is precisely the wrong approach. When we are worried about, whether the company will survive the current slump in earnings, we should not spend mental capacities on trying to complete a vision long ignored. We should do that in good times when we have the numbers to back up our ideas and the opportunities to work on the plans without the risk of catastrophic failure. Sear probably could have been saved, if they had embraced the internet and customer loyalty programs when they were at the top and not during a painful decline.

How to change?

Culture changes take a long time. The board and senior executives cannot install them overnight in a company. The first step is to change the executives stock options, to more consider the long term success instead of the results of this and the next year. Making it clear to your CEO, that you prefer good results over the next ten years instead of an outstanding one this year and a slump for the next nine is an important step to get a change of culture started within a company.

The second step is to take a critical look at your shareholder information and internal communication. Make sure that you communicate your long term vision clearly and in the first part of the statements in the key to instilling the idea in others. If you only place it in the last place of your communications, no one will take it seriously.

Conclusion

Focusing on the long term growth has been the most successful strategy for investment legend Warran Buffet. However, in today’s news cycle it is not so easy to install this vision in a company. With a few changes to your corporate culture, we can all contribute to the long term success of our companies.